thepupil

Member-

Posts

3,975 -

Joined

-

Days Won

4

thepupil last won the day on April 25

thepupil had the most liked content!

About thepupil

- Birthday 11/22/1988

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

thepupil's Achievements

-

regardless of whether i hold any, I think the CLO AAA ETF's are a great way to make a decent pre-tax return without taking duration risk, but with taking some incremental mark to market risk and credit relative to t-bills. it's pretty simple, you make SOFR + 100 -150 (5.3% +100-150 =6.3-6.8%), SEC yield on JAAA is 6.7% and you're betting on CLO's having <40% ish cumulative loss from defaults (which won't happen unless, to quote Jamie Dimon, the earth hits the moon). for a portion of someone who wants something safe, but wants to make more than bills, seems pretty good to me.

-

haha, strangely, despite having little knowledge in the sector, my timing and IRR on energy investments has been excellent over the years. mainly a bit of contrarianism and, because of lack of knowledge, a focus on lower debt/high quality co's that were around for upcycle.

-

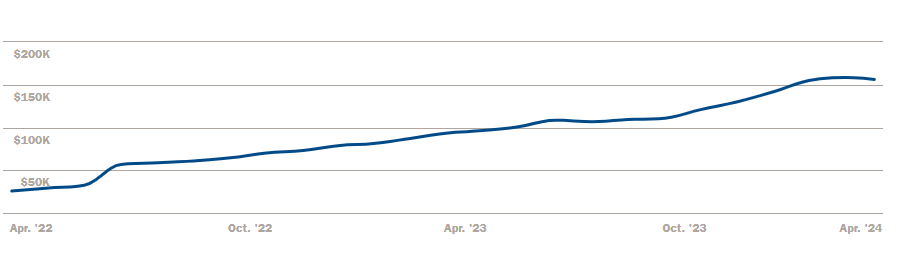

it's small for me too. here's my 401k, was it "gutsy" to just be buying bonds instead of bills/stocks as they made 0% while i contributed to this thing which is not a huge % of my NW?...at beginning of thread i said, "time to start building and I'll be way too early and wrong". so far I've been right on being wrong lol. the below is just boring, rather than gutsy...just buying something where it's really hard to lose nominal $$$'s on as rates rise because you just keep re-investing at higher rates and duration keeps dropping as your coupons get fatter. is it gutsy to have recently bought like 10% on mgn in 20-30 yrs outside of this account over the last week or 2? I really don't think its gutsy at all. the downside is really easy to think about/model (outside weimar like debasement*) and i actually think portfolio is incrementally safer layering in a little duration. maybe that makes me a baggie risk parity bro... gutsy would be going full risk parity bro and having like 100% stocks 100% of account in LT bonds. gutsy would be getting long millions of 30 yr futs. I'm not gutsy. I'm just trying to survive/ be ready for a variety of environments. to that end, I think that 4 / 5 / 6 handles on safe no default bonds demands an allocation >0%, whereas 2011-2022, for me at least, 0% was the right bond allocation. *which is why we have 2 jobs, a mortgage that exceeds all my nominal bonds, and the other 80-90% of the portfolio. but so far wrong, underperformed t-bills, should have waited two years to start. alas, I'm not good at timing.

-

yea, above example assumes one cannot (I've had years where it's made sense and years where it hasn't). if you can then tsy yield 4.8%, 3.0% after tax mgn rate 6.3%, 3.96% after tax -96 bps of carry on 30% of your portfolio you're losing ~1%/yr, only 30 bps / yr of negative carry to the whole portfolio to own some punchy recession/deflation hedges that will make you a good bit if LT rates go down.

-

2 years later after start of thread and bonds have underperformed t-bills by 4%/yr and SPY by 8%/yr as the index's yield has increased from 3.5% to 5.25% (actually yields more since that's YTW and MBS will yield more than their YTW) I'm continuing to plow the entirety of my 401k into bonds and have recently started to buy long term tsy's on margin in my taxable (having sold most of my IG corporates after the late 2023 rally). credit risk free MBS >6%, LT tsy's approaching 5%. good stuff. I'm a buyer. no corporates. IG spreads way too low in my opinion. not for everyone but if you buy say 30% in LT tsy's at 4.8% on margin at interactive brokers, at top federal tax rate, you're making 3% after tax yield, fund w/ 6.2% margin and you have negative carry of 3% on 30% of your portfolio. At constant yields you lose 90 bps/yr on the portfolio. But in a recession where rates drop just 1%, you get 30% of your portfolio going up 20%, 2% =42% for 600 - 1200 bps of PnL when you want it most from liquid monetizable instrument. if rates go up another % you lose 15% on your 30% / -450 bps. almost no mgn requirement. JPow is making bonds great again.

-

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

this one is out of blackstone's $30B fund BREP X which closed in 2023. I think the lower premium / price reflects the fact that this one is being bought by higher cost of capital institutional PE fund rather than the retail BREIT fee machine. While the 20% premium isn't some giant payday, it shows that public MF REITs clear private "opportunistic" hurdles (at least in this case, it clears BREP X's). this looks like a $6 billion equity check which seems pretty big for a $30B fund. Perhaps this will be done in conjunction w/ co-investment from say a SWF or they'll rapidly decrease the equity consideration with sales of some portion of the portfolio (a la the classic Equity Office Properties txn).....actually they'll probably put a bit more debt on it than AIRC has on it now so that's another way to decrease the equity check lol. https://www.wealthmanagement.com/investment-strategies/blackstone-raises-more-30-billion-giant-real-estate-fund -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

$AIRC -

How is the Fed going to cut rates with inflation over 3%?

thepupil replied to ratiman's topic in General Discussion

SPX sales/share for last 20 years is in high 3's-4's, EPS / share high 6's (average of 10 yr CAGR's). So I'd say the history/empirical observation is the reason. If you don't put stock in margin expansion continuing then sales/share which seems roughly in line w/ nominal GDP seems fairly predictive over long term (with lots of noise of course). there's been absolutely zero mean reversion in margins over the course of my (going on 15) year career despite people calling for it and in fact market has been more weighted to higher margin businesses, so I'm not entirely dismissing your point, but for S&P 500 at least (profitable large caps) long term per share sales growth has empirically not been to high. the Nasdaq 100 index does have higher sales growth. last 10 years for example (2023/2013), = 11% per year per share sales growth and 12% per share operating earnings growth. it trades for 35x 2023 29x 2024E and 25x 2025E -

How is the Fed going to cut rates with inflation over 3%?

thepupil replied to ratiman's topic in General Discussion

@Gregmalbecoming a long duration buyoooooor. if you really want to do this, just buy 30yr futures options....you'll get section 1256 tax treatment on the losses/gains -

Re teachers think part of this is a red state blue state thing as well. My MIL worked 20 years as a teacher in a red state, topped out at $60kw/ a PhD, $12K/ year pension. Naturally, her state is in spectacular fiscal condition. if your reference point is Illinois or NJ, and those numbers are >$100k pension, you feel differently

-

Wait We’re talking about elite MD/PhD’s? And it’s a grift for them to make < a PCP after like 8-12+ years of paying for school or making less than a living wage? (And the lowest form of hourly comp for elite professions) I just don’t get it. Honestly I think it’s a strength of the American system that our smartest people can go into research and make just okay money. but even then, I was not aware of $200K+ research positions; my only exposure to this is discussions with biotech funds who employee loads of PhD’s cheaply, because according to them research pays so poorly. Even $200k in 30’s would be well below market for someone of that caliber in any other elite profession.

-

Yes, honestly if I wanted to kneecap a smart, hardworking person’s earning potential, I’d tell them to get a PhD and try to go into academia. Almost guarantees underemployment and little net worth growth for many years.

-

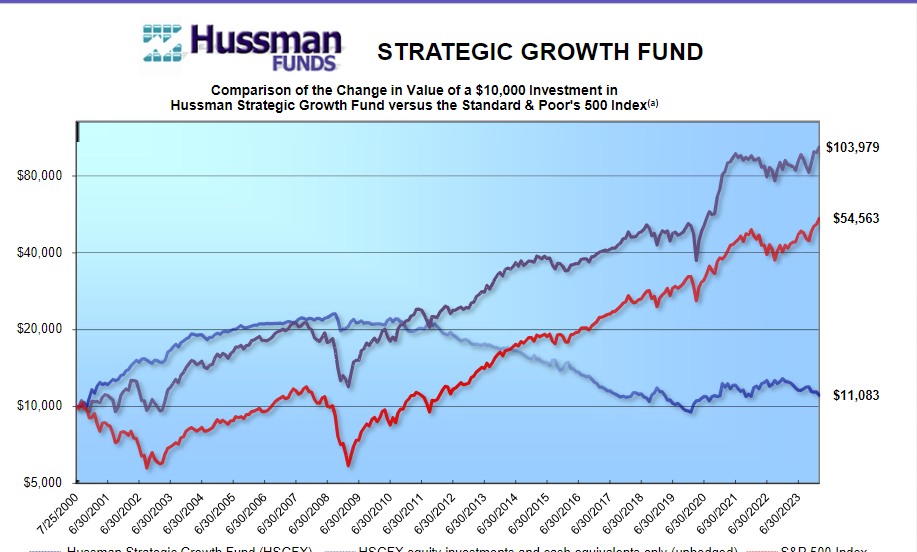

Yes, another way to frame his performance is he always hedged to beta so when he made $$$ he was generating lots of alpha; once alpha went away, no more $$$ and you just bear brunt of being short market. again just looking at the lines and not doing any analysis beyond that.

-

He said non taxable, so I’d recommend against EPD to avoid UBTI DMLP does not generate UBTI. BSM has in past but did not for me this year.

-

there it is...I don't have the underlying data, but crazy to me that he'd be a good mutual fund manager if he ran unhedged...given the unhinged overly intellectualized perma-bearism...typically those folks aren't good business analysts/stock pickers, but he, at least on an inception to date basis, appears to be.

(1).thumb.png.afef2977f5053cb2dd62f46c5f452643.png)